Invoicing obligations for online marketplaces as deemed suppliers

From July 1, 2021, online marketplaces will need to show as the deemed supplier when they are liable for VAT on invoices. But there's a lot more to take on board.

When to issue invoices, to whom, and who to show as the responsible party for the collection and remittance of EU VAT is set to become more burdensome for online marketplaces.

Other articles in this series:

- Part 1: Top 5 issues that online marketplaces face ahead of new EU VAT rules

- Part 2: Assessing marketplace liability for EU VAT on B2C sales they facilitate

- Part 3: Critical importance of the online marketplace-seller relationship

- Part 4: Why online marketplaces as deemed suppliers need to know more about product classification

Across invoicing, under the new EU VAT regulations, four key implications of the July 2021 rule changes have been identified and we outline them below:

- Issuance of a chain of invoices from sellers to online marketplaces to customers

- Self-billed invoices may also be required

- The potential to have 27 EU invoicing requirements to comply with

- Potential also to have multiple invoices per basket

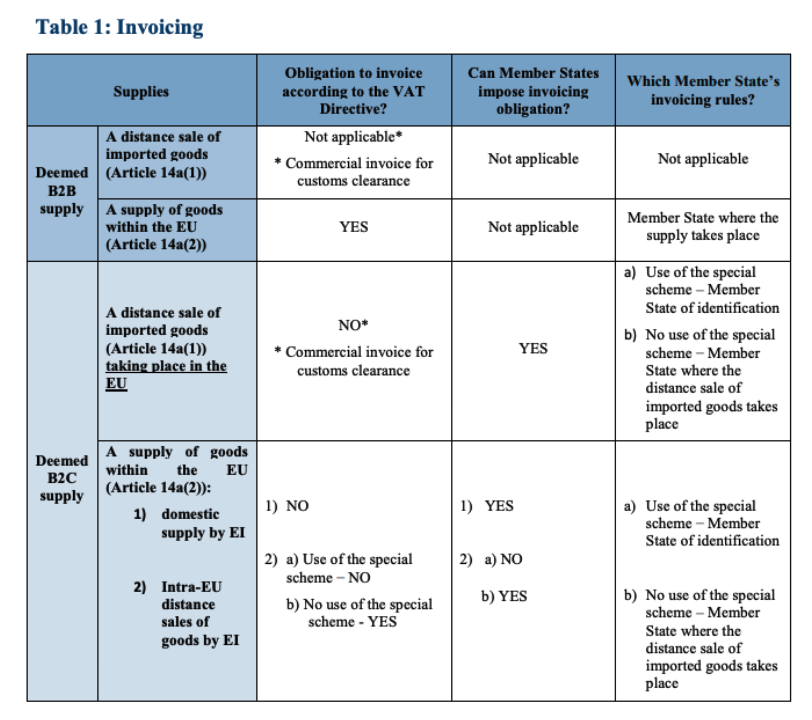

The table below is reproduced from the Explanatory Notes on VAT e-commerce rules and shows the complexity involved when it comes to invoicing for online marketplaces.

Online marketplaces will have to issue invoices that comply with a complex new set of rules. From July 1, 2021, online marketplaces, courtesy of the new EU VAT rules, will need to show as the deemed supplier when they are liable for VAT on invoices.

Self-billed invoices

In scenarios where the online marketplace is the deemed supplier of goods; the underlying seller will be legally required to issue an invoice for the deemed supply to the online marketplace when the goods being sold are in the EU. The idea of self-billed invoicing simplifies the process and ensures that the online marketplace receives the necessary invoice. The issuance of such a self-billed invoice only exists if there is the necessary arrangement for it to happen, this will involve amendments to contractual agreements.

While the idea of self-billing is a simplification it creates a burden for online marketplaces. B2B invoices for deemed sales are issued based on the rules of the EU Member State where the goods are located at the time of the deemed sale. The knock-on effect of these wide-ranging rules is the added complexity for online marketplaces in potentially having to deal with the invoicing rules of 27 EU Member States. This invoice should mention the exemption for B2B deemed sales introduced in Article 136a of the VAT Directive.

Tax liability at line-item level

As tax liability will (from July 1, 2021) be assigned at a line-item level, a typical basket of goods may well require multiple invoices to be issued to the same buyer. This is due to the possibility that liability may be dispersed among various sellers and the online marketplace itself, each requiring a separate invoice.

E-invoicing to become commonplace

E-invoicing will add substantial more complexity to doing business in the tax jurisdiction requiring e-invoicing as it means connecting to an administration’s system and involves development work on the business side.

There is the added headache that e-invoicing standards are not uniform and development work will be required on the business side to connect with each tax jurisdiction that implements e-invoicing as a requirement to doing business there.

For more information on Taxamo’s offering check out the Taxamo Marketplace page here: https://www.taxamo.com/marketplace.html

PLEASE REMEMBER THAT THIS INFORMATION HAS BEEN PROVIDED FOR INFORMATIONAL PURPOSES ONLY AND IS NOT PRESENTED AS SPECIFIC TAX OR LEGAL ADVICE. ALWAYS CONSULT A QUALIFIED TAX OR LEGAL ADVISOR BEFORE TAKING ANY ACTION BASED ON THIS INFORMATION. VERTEX INC. ACCEPTS NO LIABILITY FOR ANY LOSS RESULTING FROM ANY PERSON ACTING OR REFRAINING FROM ACTION AS A RESULT OF THIS INFORMATION.