Indirect tax monitoring with Vertex-SAP Integration

Enterprises of all shapes and sizes must stay informed of change and be proactive in indirect tax monitoring.

Businesses, both large and small, are navigating complex and evolving indirect tax regulation. The UK's Making Tax Digital (MTD) initiative, along with a variety of EU digital reporting requirements, for example, demand advanced systems to ensure accurate and timely tax filings. The UK’s recent increase in the VAT registration threshold to £90,000, the first adjustment in seven years, aims to ease the compliance burden on smaller businesses, but it also underscores the growing importance of robust tax automation solutions for efficient management.

The dynamic nature of indirect tax legislation also presents a significant challenge for businesses within different sectors. The UK's recent introduction of the Plastic Packaging Tax and the overhaul of its alcohol duty system, aligning rates with alcohol content, each highlight the need for strategic planning and automation to adapt to evolving tax rates and regulation.

Failure to adapt can lead to costly penalties and stifle business growth. Specialised tax technology can provide the tools and insights needed stay compliant, optimising your tax management strategy so that new opportunities for sustainable growth and competitiveness can be unlocked.

Stay informed, embrace technology, and seeking expert guidance for your business.

Indirect tax monitoring in SAP with Vertex PLUS tools.

For companies using SAP, Vertex has developed a suite of innovative tools and solutions to simplify and automate, to further improve accuracy and efficiency while minimising risk.

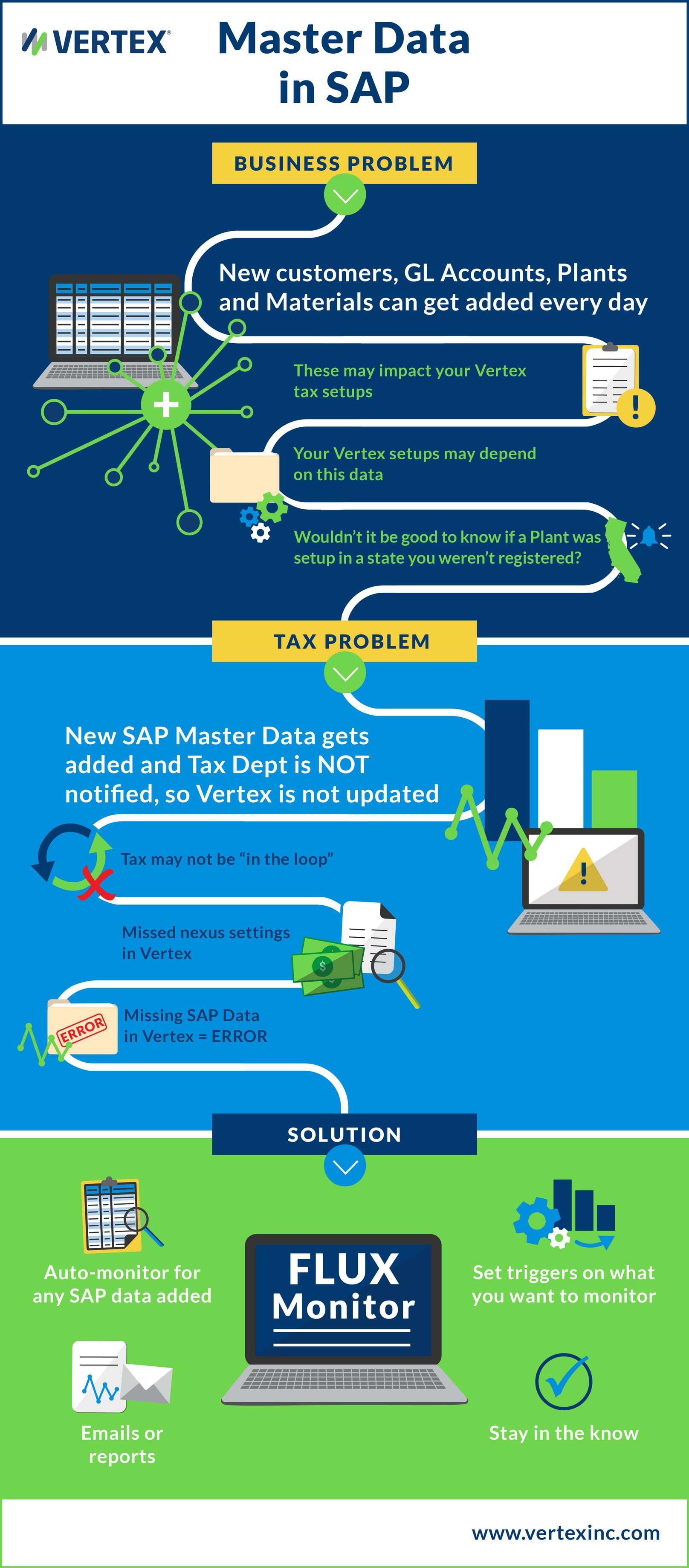

FLUX Monitor is a powerful tool designed to track and alert users about changes in SAP data that could impact tax obligations. This proactive approach eliminates the need to rely solely on master data in SAP, keeping tax-related configurations current and compliant. Whether it’s new plant added in a new location or new general ledger account, FLUX Monitor can track the updates giving you the insight to stay current with registrations and setups in Vertex.

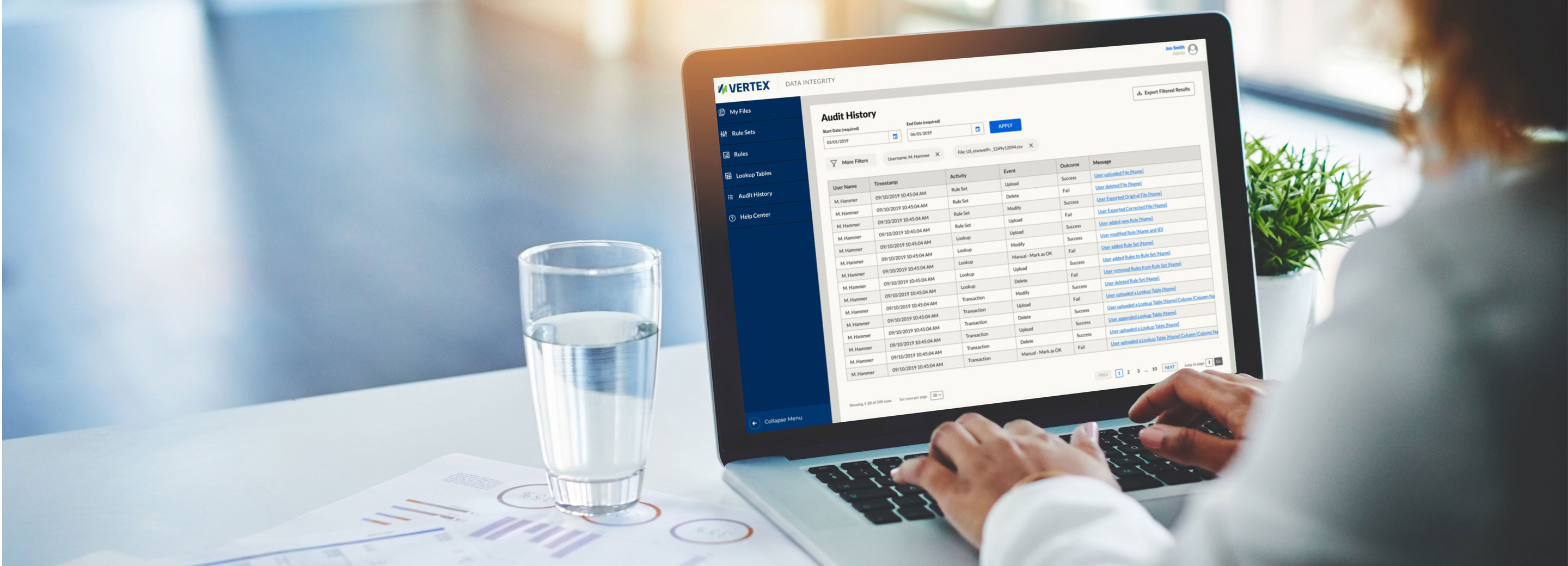

FLUX Monitor provides a detailed audit trail of data updates, offering valuable insights into potential tax implications, plus seamless integration with Vertex.

Empowering control and efficiency in SAP master data management

- Monitors changes in customers, GL accounts, company codes, cost objects, plants, and more

- Eliminates the need to rely on SAP master data teams

- Provides a detailed audit trail of data updates

FLUX Monitor

Solve tax pains in SAP

Optimize the integration between Vertex and SAP with PLUS Tools. These tools provide SAP customers using Vertex market-leading, customer tested and accepted tax management solutions.

Beyond FLUX Monitor, there’s a comprehensive ecosystem of tools to optimise Vertex-SAP integration: Vertex PLUS Tools. The tools address a wide range of tax-related challenges, providing SAP users with market-leading, customer-tested solutions. Automating processes, streamlining workflows, and providing real-time insights, these solutions will empower your business to achieve greater accuracy, efficiency, and compliance. The result is a more robust and reliable tax management system that minimises risk and maximises operational efficiency.

Check out all PLUS Tools for SAP users here

Vertex and SAP have a partnership spanning over 25 years. It’s a commitment that delivers automated tax solutions to over 900 mutual clients, helping them achieve greater tax accuracy, consistency, and compliance across their operations.

Learn about our SAP Partnership

We've partnered with SAP for over 25 years, enabling over 900 mutual clients to benefit from automated tax solutions that enable more accurate and consistent taxation across the enterprise and around the world.

Learn More